Is recession coming in India 2024?

2024年印度会出现经济衰退吗?

以下是Quora网友的评论:

Nick Genero-Forex Trader

Though with slight decline in exports and other data being negative still Indian economy is very strong and confidence is high among people. As off now there is no chance of recession atelast in India but yes if some how war happens between India-China-Pak (Which is again unlikely to happen) only then we might experience recession. Else enjoy bull run for now.

尽管出口略有下降,其他数据也仍较负面,但印度经济还是非常强劲的,人们的信心很足。到目前为止,印度不可能出现经济衰退,但如果印、中、巴之间爆发战争(这也是不太可能发生的),我们也许会经历经济衰退。否则的话就先好好享受一波牛市吧。

Subhash Mathur

Exports have slowed down . PMI has gone down .

Combined it means manufacturing for both exports and local consumption has slowed down .

Which in effect means lots of average skills have lost jobs .

Since they are not earning any longer their families would be short of cash to buy groceries .

Slowdown in Exports is largely due to global recession world wide. All nations are feeling the pinch.

印度的出口已经放缓。采购经理人指数PMI也下降了。

这意味着为出口和本地消费的制造业都放缓了。

这实际上意味着许多普通技能的人失去了工作。

由于他们不再赚钱,他们的家庭将缺乏现金来购买杂货。

出口放缓主要是由于全球经济衰退。所有国家都感受到了压力。

Naturally it has impacted Indian consumption levels aided by high inflation.

Will recession spread to other sectors like services and agriculture? I can't say at the moment as I don't have the required data .

But keep your fingers crossed.

在高通胀的背景下,印度的消费水平自然受到了影响。

衰退是否会蔓延到服务业和农业等其他行业?我现在还不敢断言,因为我没有所需的数据。

但请一起祈祷吧。

Ram Patil

What makes you think that recession is coming in India?

是什么让你认为印度即将陷入衰退?

1.It hardly matters if recession comes to India.

2. Recession matters to those who buy dollars, buy gold, invest in real estate, invest in Mutual funds and shares.

3. 80 % of the Indians are not affected by the recession because they cut their coat as per the cloth.

4. It hardly matters if the petrol is Rs 150 /- for a litre because he buys in Rupees. He buys Rs 100/- petrol and does not bother whether it is 1.3 litres or 0.7 litres.

1.如果印度遭遇经济衰退,影响也不大。

2. 对那些购买美元、黄金、房地产、共同基金和股票的人来说,经济衰退会给他们造成影响。

3. 但80%的印度人不会受到经济衰退的影响,他们的收入都只能维持生活。

4. 即使汽油价格涨到每升150卢比也没关系,因为印度人还是用卢比购买,他们支付100卢比,也不用操心买到的是1.3升还是0.7升的汽油。

5. The Chaiwala serves tea in a smaller cup for Rs 10 /-. The customer does not bother about the quantity or quality of the tea.

6. The Wada Pav wala reduces the size of the vada, uses substandard oil and serves it to the customers with the same smile.

7. The vegetables prices have doubled but the customers are buying vegetables. They buy brinjal, pumpkin and leafy vegetables instead of mushroom, broccoli, coloured capsicums, lettuce etc.

5. 茶贩子用小杯子卖茶,每杯10卢比。顾客也不在乎茶的数量和质量。

6. 小贩们把炸豆饼做小点,用劣质油,还是带着同样的微笑为顾客提供服务。

7. 蔬菜的价格就算翻上一倍,顾客们也还是得购买蔬菜。他们会买茄子、南瓜和绿叶蔬菜,不再购买蘑菇、西兰花、彩色辣椒、生菜等。

8. Their priority is entirely different. Indians spend lavishly on marriages, dowry, religious rituals and celebrations of religious festivals.

9. As per VED and ABC analysis, religion, faith, rites, rituals are some of the heads which fall under VITAL needs. Health, Education etc fall under Essential head and ROTI, KAPDA and MAKAN falls under DESIRABLE category.

8. 他们考虑的重点完全不同。印度人在婚姻、嫁妆、宗教仪式和宗教节日的庆祝活动上非常壕。

9. 根据VED和ABC的分析,宗教、信仰、仪式、典礼等都是很重要的需求。医疗、教育等属于基本类别,ROTI、KAPDA和MAKAN属于理想类别。

Wasim Ansari

There are many reasons for the Indian economy slowdown.

Today I will highlight on manufacturing sector in India.

India's manufacturing sector have come down from 12% to 0.5%. Indian textile industry has played a vital role in decreasing the economy of India and I would say the government is ignoring the slowdown in our core sector.Wait I have a proof

印度经济放缓的原因有很多。

今天我要重点介绍一下印度的制造业。

印度的制造业比重已经从12%下降到0.5%。印度纺织业在印度经济下滑中发挥了至关重要的作用,我想说的是,印度政府忽视了核心行业的放缓。等等,我有证据的。

Yesterday I bought H&M Jeans from their store and I was shocked to see country of manufacture.Yes it was Bangladesh .Bangladesh is taking all our textile industry and government is sitting quiet on this.

They don't have any future plans to tackle this,and this also shows the failure of MAKE IN INDIA.

I am not getting harsh on Modi government,but they advertise their policies a lot ,so they should take feedback also and work on it.

昨天我在店里买了一件H&M牛仔裤,我看到产地的时候非常震惊。没错,裤子是孟加拉国产的。孟加拉国抢走了印度的纺织工业,而印度政府对此毫无作为。

他们没有制定任何计划来解决这个问题,这也显示了印度制造的失败。

我并不是苛责莫迪政府,但他们经常宣传自己的政策,所以也应该接受反馈并努力改进。

Rohit Virmani

A global recession is just around the corner.

全球经济衰退即将来临。

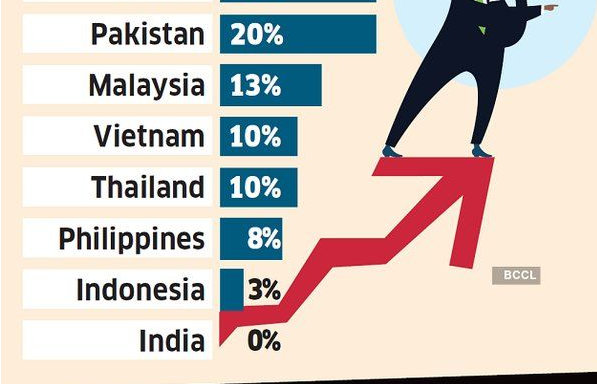

A Bloomberg survey has attempted to gauge the percentage probabilities of various countries slip into recession. India has zero percent chance of slip into recession.

However, the US has not fared well in the survey as economists believe that there is a 40 per cent chance of the country slip into a recession by next year.

India’s domestic economic factors are positive that can insulate India from any major negative impact of a global adverse economic event.

彭博社展开了一项调查,旨在测评各国陷入经济衰退的概率。印度陷入衰退的可能性为零。

但美国在此项调查中表现不佳,经济学家认为,美国明年陷入衰退的可能性达到了40%。

印度的国内经济因素较为乐观,可以让印度免受全球负面经济事件的不良影响。

Shyam Sunder Lal

Is India going into economic crises?

印度会陷入经济危机吗?

India is in economic crisis.?

Few points..

Inflation has risen to about 8 percent..

Unemployment has also risen to about 8 percent..

Rupee value has risen to 77.78 per dollar..

RBI has increased repo rate by 40 basis points..in June meeting of MPC will take further call to increase repo rate by say 80 basis points..and it is predicted that such increases will continue for next few months..

CRR also increased by 4 percent..

印度现在就已经处于经济危机之中了吧?

我举几个例子

通货膨胀率已上升到8%左右。

失业率也上升到8%左右。

卢比兑美元汇率已升至77.78。

印度央行已经将回购利率提高了40个基点,在6月份的货币政策委员会会议上,还将进一步呼吁将回购利率提高80个基点,预计未来几个月还会维持这样的加息趋势。

现金储备比率也增加了4%。

Each of these economic indicators have specific implications..

For example..

Rupees value against dollar has gone down would mean that our import cost will go up which will further put pressure on inflation..and Export should get benefit..however since most currencies have been devalued..it's impact will be limited..

在这些经济指标中,每一项都有特定的含义。

例如:

卢比兑美元贬值意味着我们的进口成本会上升,这将进一步给通胀带来压力,出口本来应该会因此受益,但鉴于全球大多数货币都贬值了,因此对出口的影响较为有限。

Remember we import 80 percent of our petroleum products and crude oil..so all petroleum products will become still more costly ..which will further put pressure on inflation..

We import hugh amounts of consumer and industrial products from many countries specially from China..all these imported products will become more costly..just a point to highlight that our international trade with China as announced recently stood at 125 billion dollars..out of which 80 percent are our import and 20 percent export..

Imported goods will become more costly..

记住,印度80%的石油产品和原油都依赖进口,所以石油产品将会全线涨价。这将进一步给通货膨胀带来压力。

我们从许多国家进口大量消费品和工业产品,尤其是中国,这些进口产品将变得更加昂贵。而且还需要强调的一点是,根据最近公布的数据,我们与中国的贸易额达到1250亿美元,其中80%是进口,只有20%是出口。

进口商品的价格将上涨。

Education loans taken by students for going abroad will get costlier..

Thus it will impact our economy negatively..

As far as inflation is concerned it is going up steadily..

Along with it unemployment too have been hovering very high..

When unemployment is high purchasing power of people get hampered..which affect private consumption.

学生出国的教育贷款会越来越高。

因此,这将对我们的经济产生负面影响…

通货膨胀正在稳步上升。

与此同时,失业率也一直居高不下。

当失业率升高时,民众的购买力就会下降,影响私人消费。

With high interest rates further growth momentum get halted..that affects employment generation..

Such situation in Economics is called Stagflation..that means high inflation with muted growth..

Indeed very difficult situation to handle economy..

I suppose government should be alert on these implications..

高利率阻碍了进一步的增长势头,影响了就业机会的创造。

这种情况在经济学上被称为滞胀,即高通胀和低增长。

经济确实很难处理。

我认为政府应该警惕这些负面影响。

Ross.Lederhman

I think the recession is coming soon, what do you think?

I think it's irrelevant. Every bubble and recession period offers fantastic opportunities, job wise as well as trading wise. The discussion about “is a recession coming”, to me is irrelevant.

我认为经济衰退很快就要来了,你认为呢?

我认为这无关紧要。无论是工作还是交易,每个泡沫和衰退时期都提供了绝佳的机会。对我来说,关于“经济衰退是否迫在眉睫”的讨论都没有意义。

The financial markets are that saturated that when the market will plummet, many will be able to short it to oblivion and make a truck load of money. As long as you have the flexbility to move, job security is not an issue either.

Only people who are massively in debt (engage in rubbish like “floating” interest rate debt), buy more than they earn, have high fixed costs, etc will be in trouble. Like back in 08′.

Trying to predict a recession will lose you years of your life. I remember after the mortgage bubble, every month they (journalists) anticipated a new crash.

金融市场已经饱和,当市场出现暴跌时,很多人都能做空金融市场,赚得盆满钵满。只要你能灵活调动,工作保障也不是问题。

只有那些债台高筑的人,超前消费、成本负担大等等,才会陷入困境。就像08年那样。

试图预测经济衰退只会让你浪费时间。我还记得,在次贷危机泡沫发生之后,他们(记者)每个月都在预测新的崩盘。

Just use common sense. The typical high p/e stocks will drop like buckets during a crash, and the ones with low capital buffers will go bankrupt. If a country isn't careful, bankruns will happen once again and the yield of their rotten bonds will skyrocket. It's not rocket science to “avoid getting hurt” during a recession. You know which countries or firms are high risk and which ones aren't. If you invest in a firm with a P/E of 250, barely any income whatsoever, debt like no tomorrow, would you really be surprised if they dop like flies during a recession?

但大家只需要用点常识就可以了。典型的高市盈率股票在崩盘是会像自由落体一样暴跌,那些资本缓冲较低的股票将会破产。如果国家不够谨慎,就会出现银行挤兑,不良债券的收益率将飙升。在经济衰退期间“独善其身”并非易事。你知道哪些国家或公司是高风险的,哪些不是。如果你投资的公司市盈率为250倍,几乎没有任何营收又债台高筑,那么如果它们在经济衰退期间出现暴跌,也不足为奇吧?

But focusing on that too much, not relevant. And as long as you as firm, person, couple make sensible common economic decisions you'll survive, even thrive as firm.

Will we get into another recession? Eh, hell yeah. Have you looked around whats happening? But before a full scale recession can start you need a proper catalyst and that can be everything. From Brext to another bank falling over.

但过分关注这个也没有必要。作为企业、个人、夫妻,只要你做出明智的共同经济决策,你们就能生存下去,甚至茁壮成长。

我们会陷入另一场衰退吗?嗯,当然。你观察过周围发生了什么吗?但在全面衰退开始之前,你需要一个合适的催化剂,一切皆有可能,从英国脱欧到又一家银行倒闭。

Until then, its always best to keep going, and hedge your bets (somehow, someway), whatever you do. Recessions are as natural as people dying. Firms react on that naturally, you can see Brext caused many firms to flee from England and set up shop in Europe in anticipation of a crisis. That's called hedging your bets. No idea if a recession is coming, but adjusting to the current climate of risk to keep exposure low. That doesn't mean hedging means losing money. I know plenty of firms who earn significantly on their structural hedges.

在那之前,最好还是继续前进,并(采用某种方式)进行对冲。经济衰退就像人的死亡一样自然。公司对此自然会做出反应,英国脱欧就导致了许多公司逃离英国,在欧洲设立工厂来应对危机。这就是所谓的两面下注。大家都不知道经济衰退是否会到来,但要适应当前的风险环境。这并不意味着对冲意味着赔钱。我知道很多公司通过结构性对冲赚了大钱。

Arijit

There is very less or no chance of India getting into recession.

There is a recent report from Bloomberg on the percentage chances of a country going into recession.

印度陷入衰退的可能性非常小,甚至为零。

彭博社最近发布了一份关于各国陷入经济衰退的概率百分比的报告。

Big economies like China,Japan, S.korea having high chance of recession. But on the other hand, india has 0% chance of getting into recession.

中国、日本、韩国这样的大型经济体很有可能陷入经济衰退。但印度陷入衰退的可能性为0%。

(VIP)这才是衡量印度经济发展的尺

(VIP)这才是衡量印度经济发展的尺 (VIP)印度经济专家这样计算中国实

(VIP)印度经济专家这样计算中国实 (VIP)印度经济规模只有中国的六分

(VIP)印度经济规模只有中国的六分 (VIP)印度民族主义者认为印度是超

(VIP)印度民族主义者认为印度是超 印度拥有全球最大的黄金储备,为什么

印度拥有全球最大的黄金储备,为什么 印媒:到2035年,煤炭行业的衰退将使40

印媒:到2035年,煤炭行业的衰退将使40 种姓制度是如何阻碍印度经济腾飞的

种姓制度是如何阻碍印度经济腾飞的 印度第一季度GDP数据显示,印度经济

印度第一季度GDP数据显示,印度经济